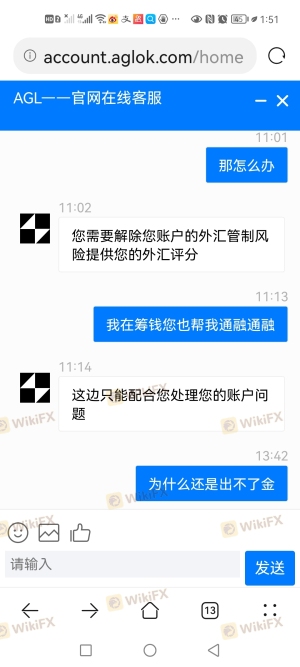

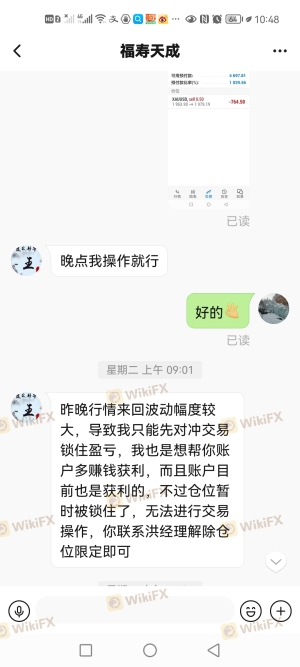

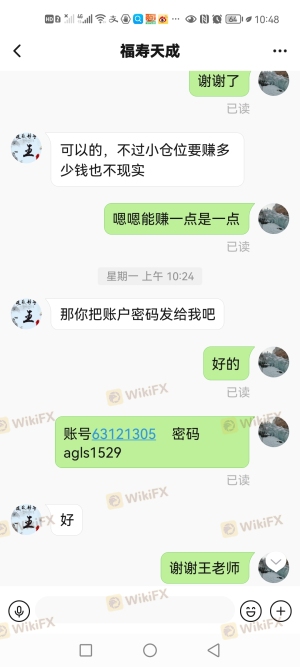

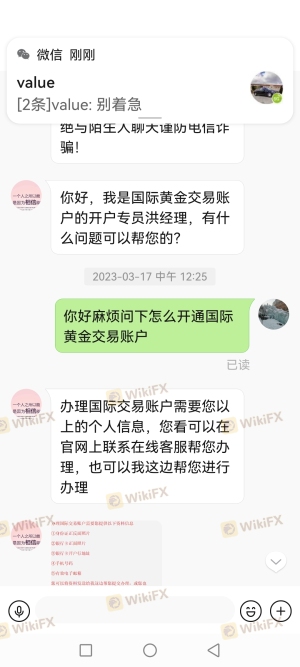

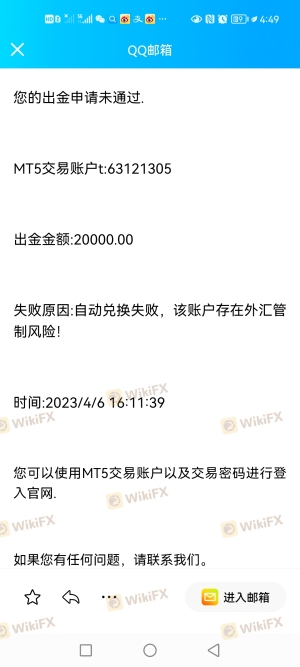

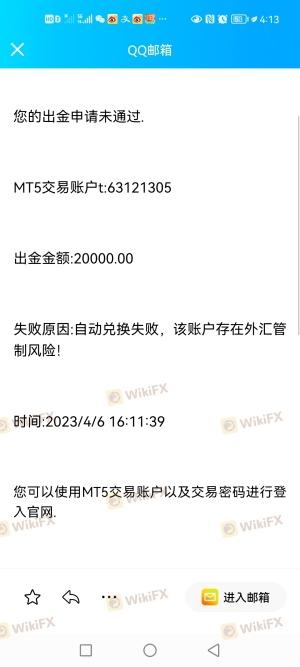

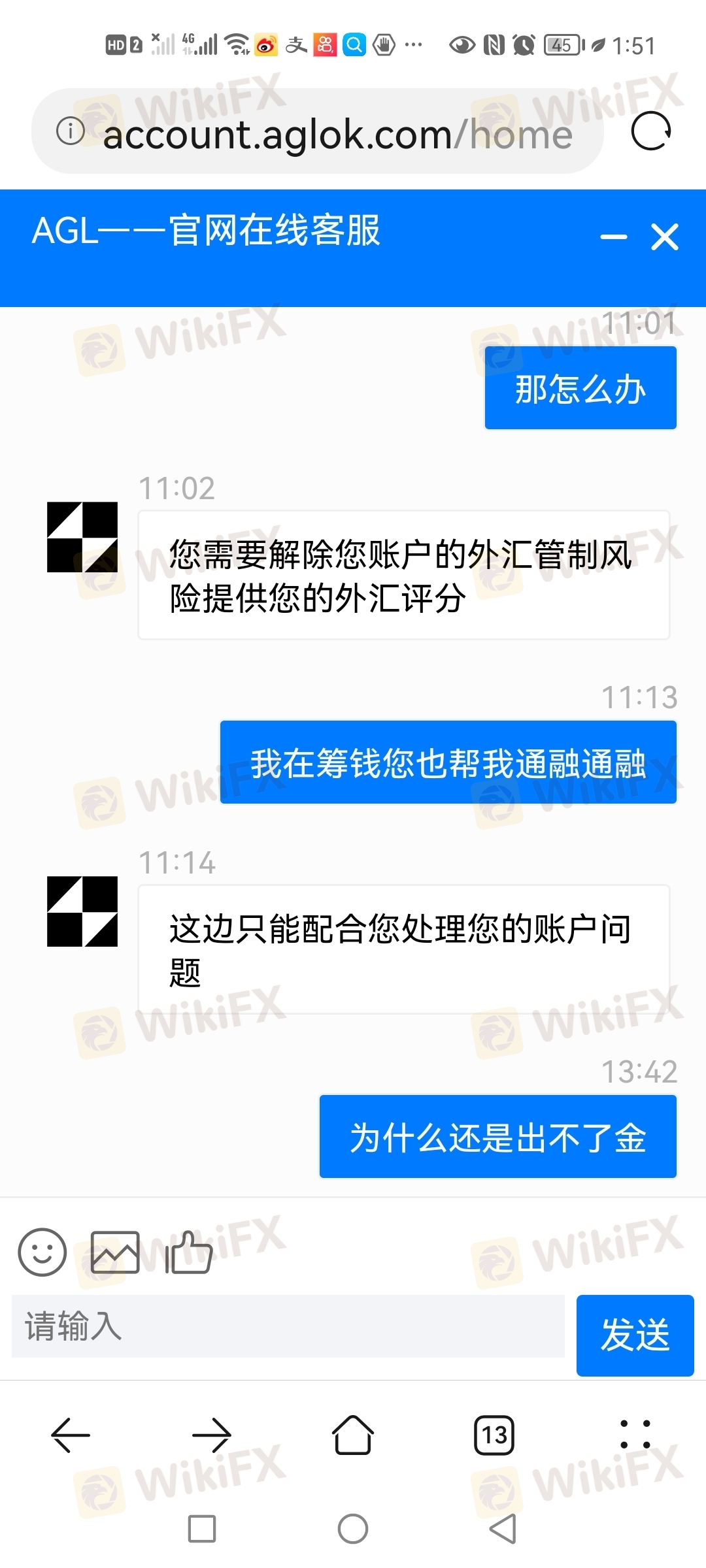

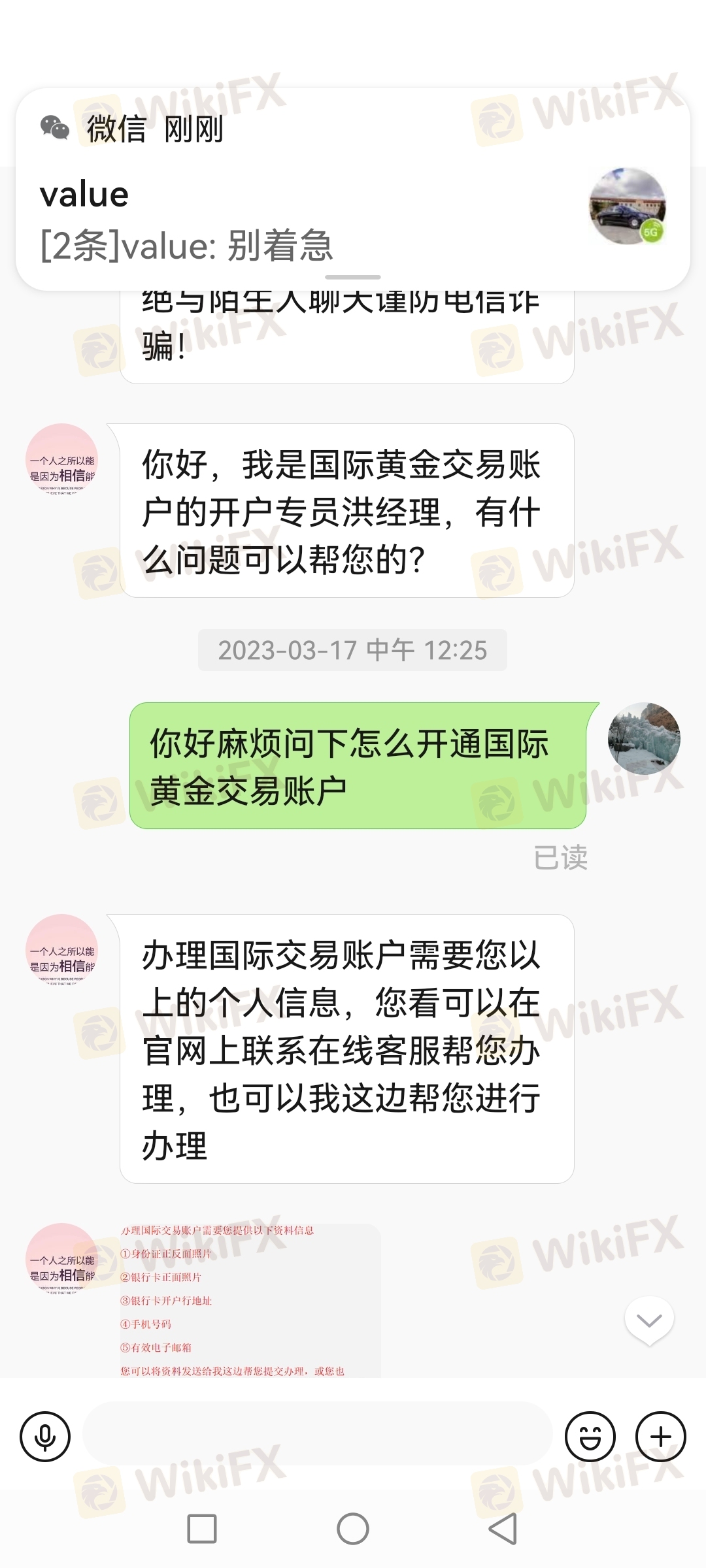

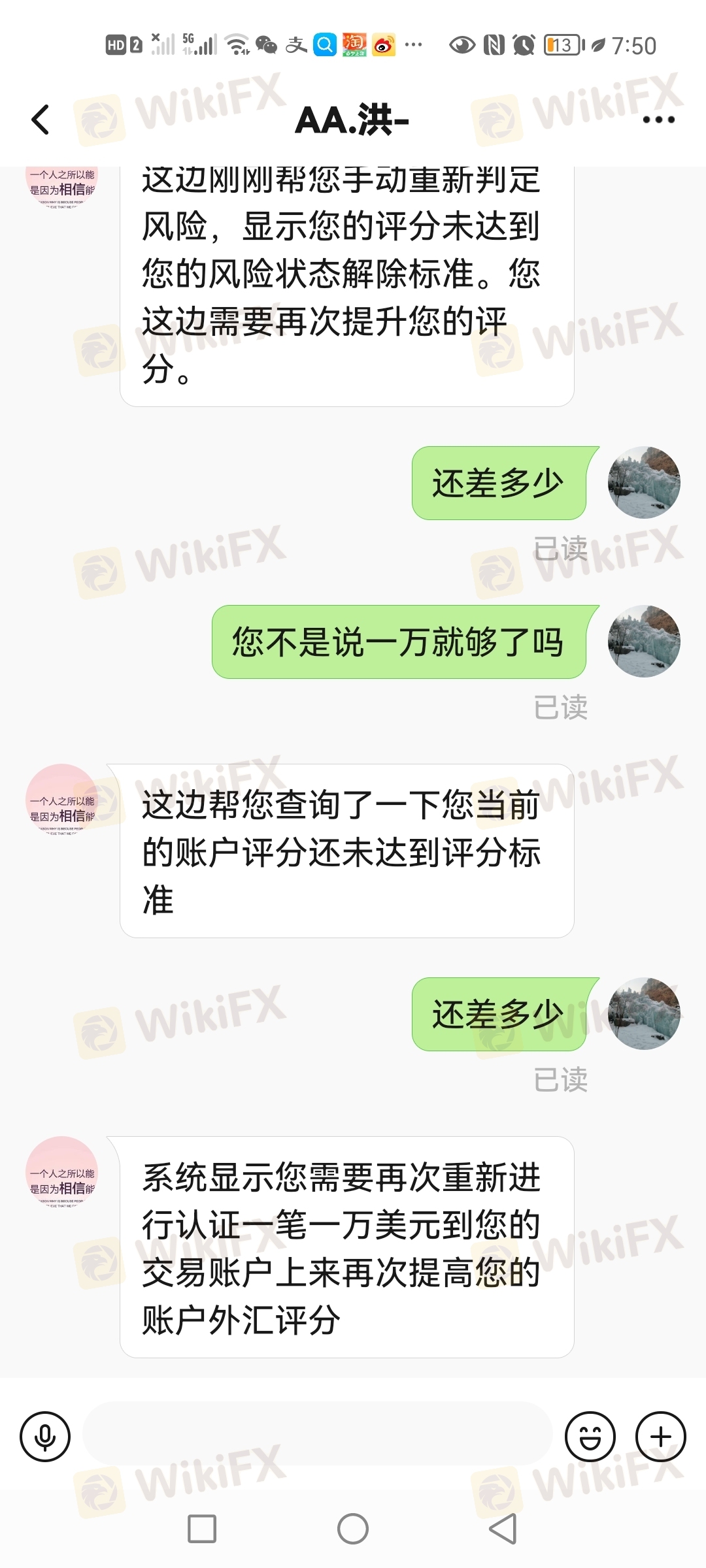

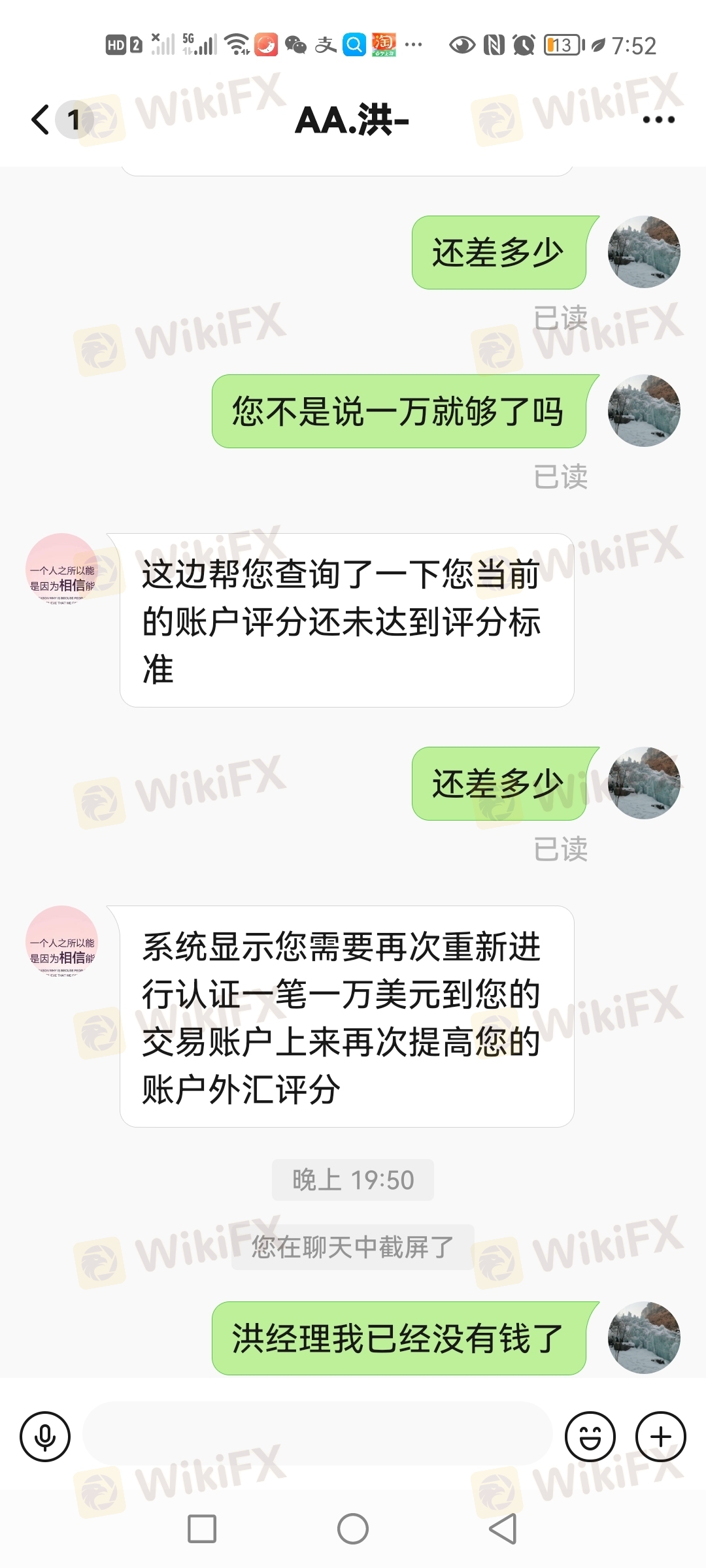

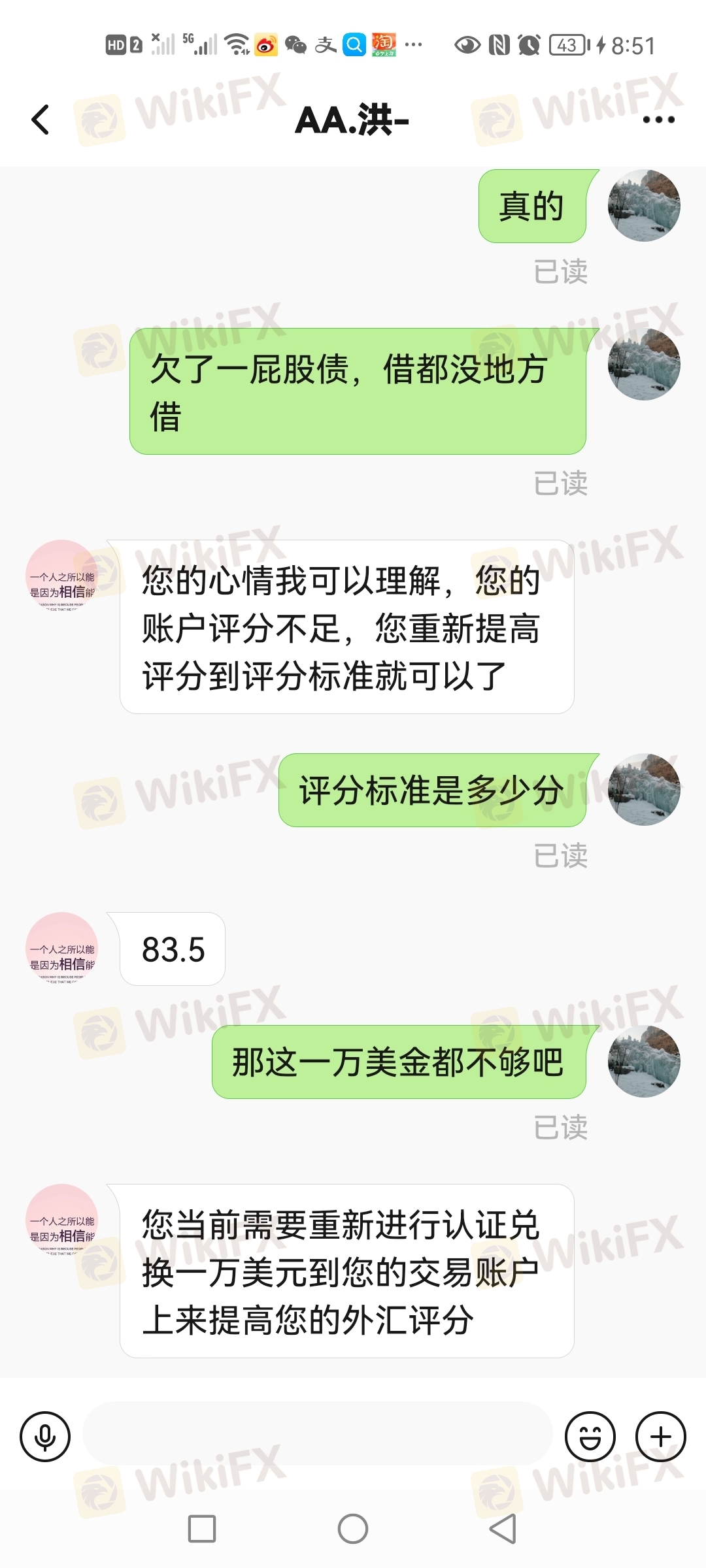

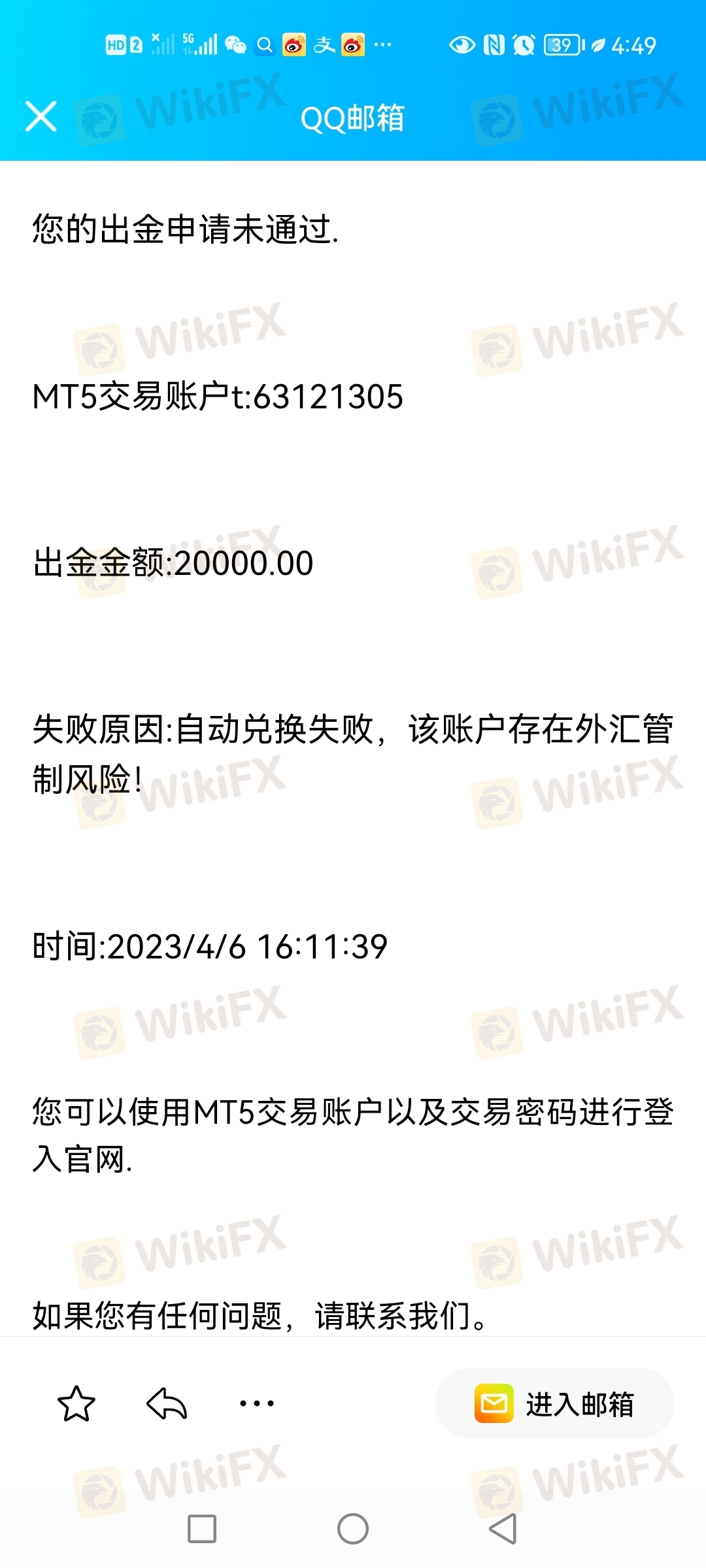

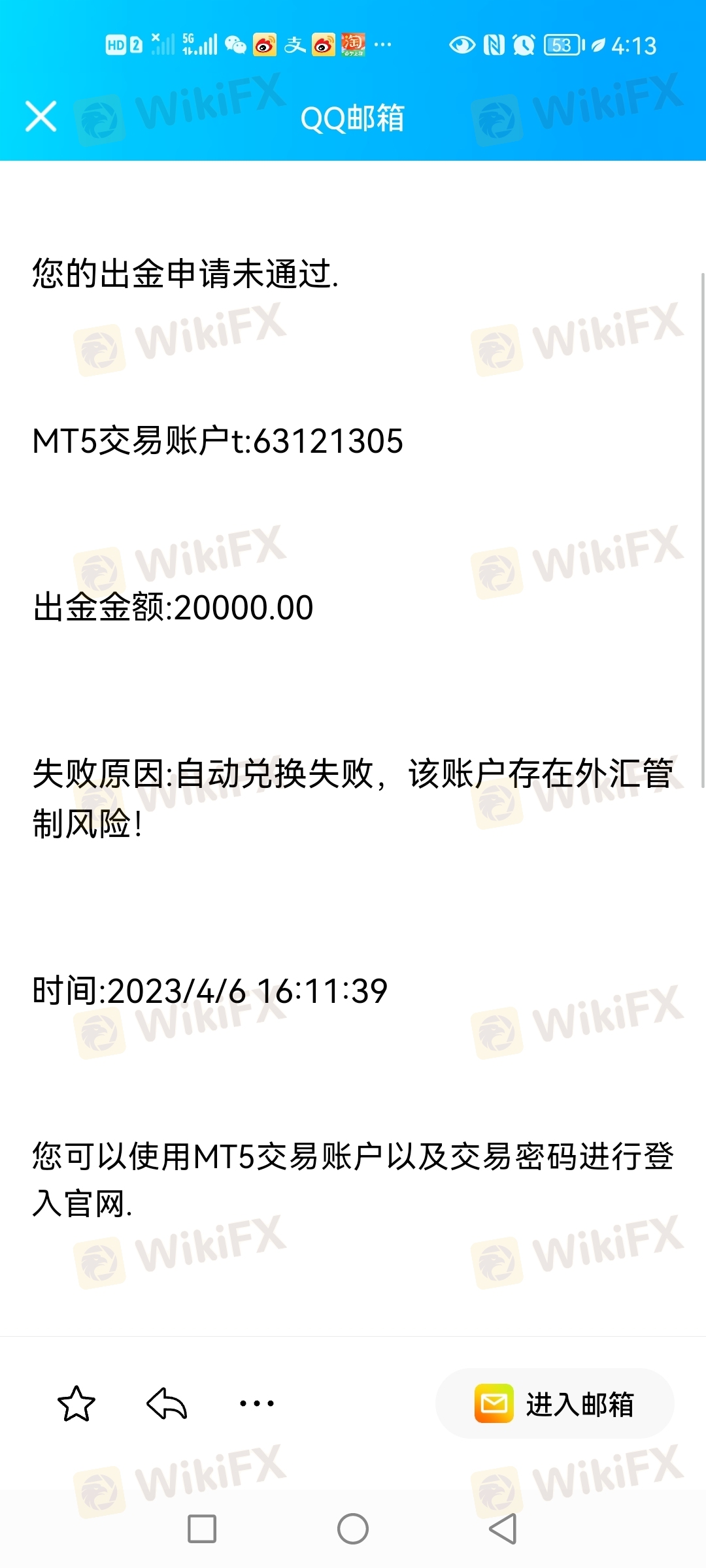

系统无法出金,要求在充值两万美金才能出金

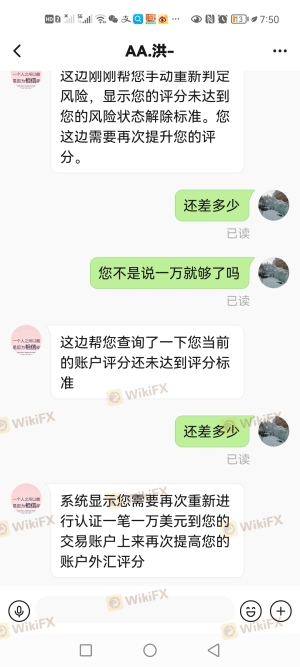

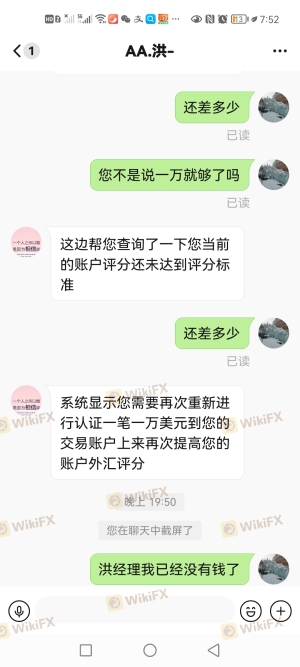

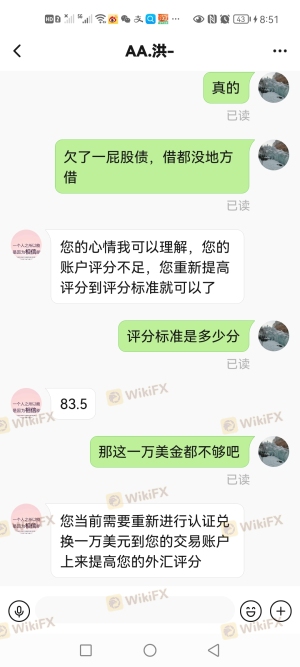

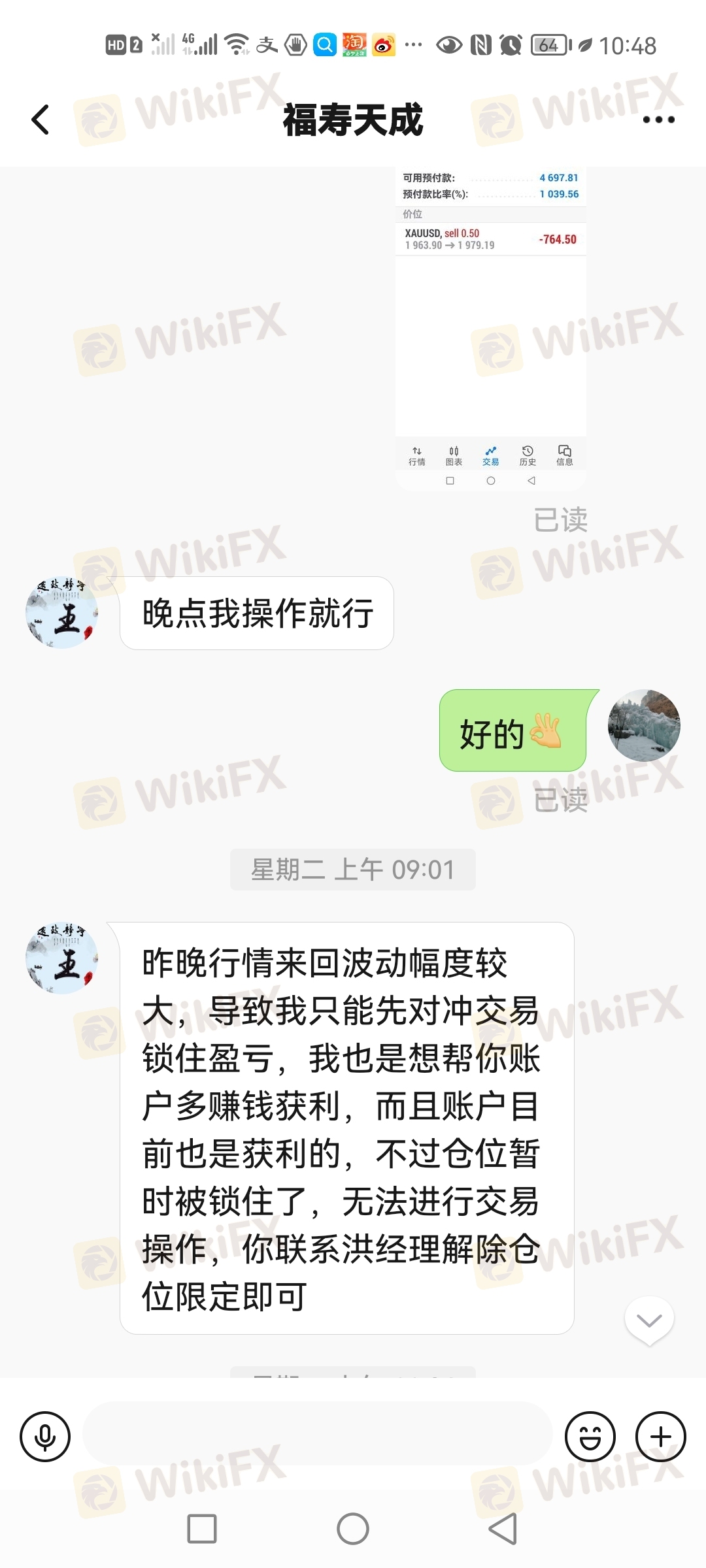

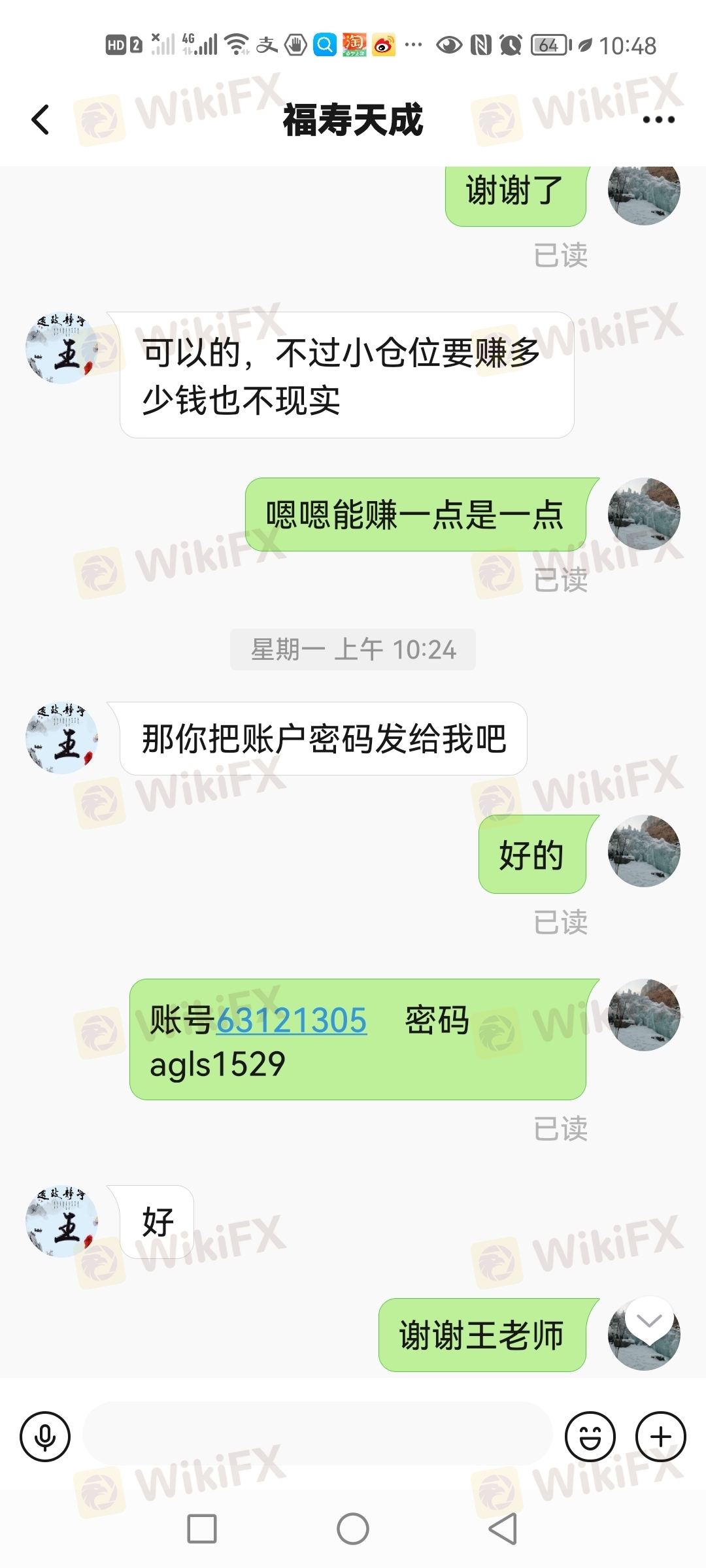

平台带操作工作人员故意锁仓,然后要求充值美金,账户解封,却出不了金,又要求充值两万美金,请官方帮忙追回,急等用钱

无法出金

无法出金

Source:外汇天眼

Risk Reminder and Disclaimer:

[Reminder]News sourced from 外汇天眼,Organize and publish by AHCFX.Reprint and indicate the source of the original text. The viewpoint of this News is not related to Aihuicha. It is read rationally and the copyright belongs to the original author. If you do not intend to infringe on media or personal intellectual property rights, please contact us and our website will handle it as soon as possible.