Generally speaking, an increase in oil prices is a good thing for companies extracting oil from underground sources, but there are also limitations to this.

A crude oil price close to $100 per barrel may lose its attractiveness to all relevant market participants. For most of this year, the global benchmark Brent crude oil price has been below the $90 per barrel level, but in early September, it slightly exceeded this threshold. Saudi Arabia and Russia have stated that they will extend their voluntary production reduction measures, even some bearish analysts believe that crude oil prices may rise to $100 per barrel, even if it is only for a short period of time.

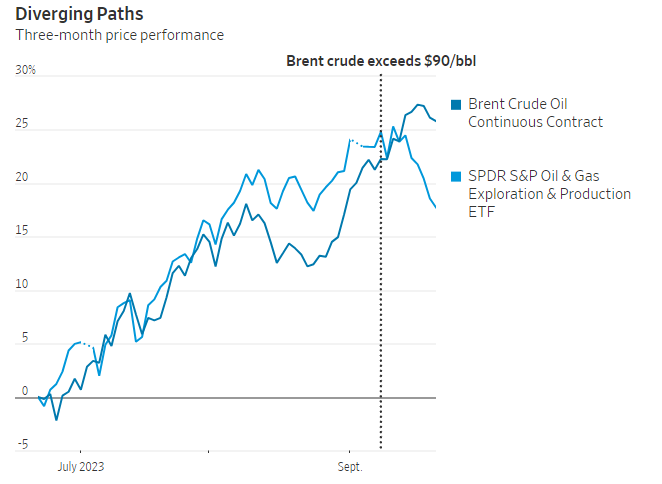

Although the stock prices of oil and gas producers have mostly fluctuated in sync with oil prices over the past year, this relationship has clearly broken down. Since September 8th, since Brent crude oil closed above $90 per barrel on September 8th, oil prices have risen by 2.6%, while the Oil Producers Index has fallen by 5.3%. The decline in the index may be a natural adjustment after rapid growth since 2021, but for energy investors, it may be wiser not to invest too much capital as market conditions may have changed.

One of the reasons why the market remains cautious is the impact of high prices on demand. Generally speaking, oil prices above $100 per barrel are often a pain point for drivers, prompting some people to reduce their driving habits. In June and July 2022, when Brent crude oil prices averaged around $110 per barrel, gasoline demand in the United States, the world's largest oil consumer, decreased by 4.1% compared to the same period a year ago when oil prices were around $70 per barrel. A few months later, as oil prices fell, the year-on-year gap in gasoline demand narrowed.

According to data from the Bank of America Research Institute, in August 2022, savings and checking accounts of American households with annual incomes between $50000 and $100000 were approximately 50% more than pre pandemic levels, compared to nearly 100% before. According to some statistical estimates, when the student loan repayment plan resumes next month, it will reach approximately $100 billion per month, which may further erode the financial situation of more households.

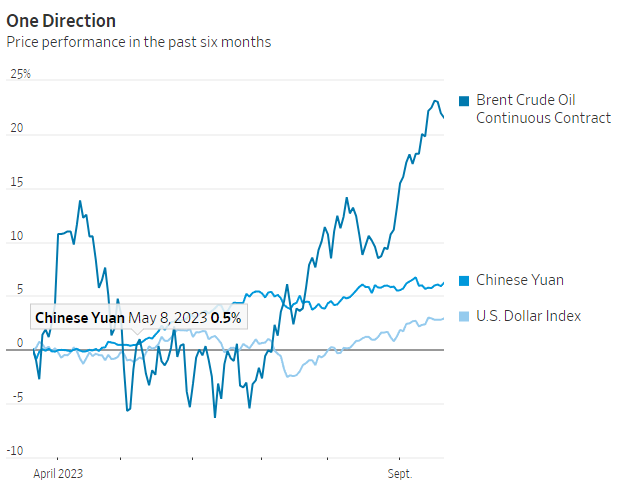

The risk of a decline in fuel consumption is particularly high in developing countries. Ilia Bouchouev, managing partner at Pentathlon Investments, pointed out that although oil prices and the value of the US dollar often move in the opposite direction, they have been rising in sync recently. This has brought additional pressure to countries such as China and India that must purchase oil denominated in US dollars.

He said, "This will cause a double blow, as the rise in oil prices is magnified by the appreciation of the US dollar and the depreciation of the local currency

In US dollars, Brent crude oil prices have risen by approximately 7.4% so far this year. In RMB terms, it has increased by 13%. Although the price ceiling of Russian oil helps alleviate this impact, China and India also purchase oil from other countries.

In addition, oil prices breaking through psychologically important price levels may trigger a negative government response to energy companies. Last year's record breaking profits from oil companies prompted the European Union to impose a windfall tax on fossil fuel companies. US President Biden also threatened to launch similar measures. The longer high prices persist, the greater the government's response may be. For example, after the oil price shock in the early 1970s, the United States passed a regulation called "Fuel Economy Standards" in 1975.

So what is the most reasonable price? Dan Pickering, Chief Investment Officer of Pickering Energy Partners, estimates that oil prices of $75 to $90 per barrel are prices at which producers receive acceptable returns and demand is "on the verge of being suppressed". The future curve of the futures market reflects this expectation: for example, the oil futures contract for delivery in October 2024 is trading at a price below $84 per barrel today.

Analysts believe there are other reasons to believe that oil prices will not remain above $100 per barrel for the long term. According to data from the International Energy Agency, Saudi Arabia has approximately 3.3 million barrels of idle production capacity per day. If they see signs of oil prices affecting global economic growth, then it has a strong incentive to increase oil supply. But this does not mean that oil will stop hovering around the price of $100 per barrel. Arjun Murti, a partner at Veriten, an energy investment company, said that given the slowdown in shale oil production in the United States and signs of reduced idle capacity in various oil producing countries, oil prices may "frequently rise to $100 per barrel, but also frequently fall back.

However, if there is some physical damage or unforeseeable geopolitical factors, oil prices may remain above $100 per barrel for a long time. But this situation is something that no one should hope to see, even oil industry giants should not hope for.